When you’re heading to the Queen’s country you have to have your finances in order. This includes understanding how to establish and build credit as a new expat in the UK.

Your credit score is a statistical tool to predict the likelihood of you defaulting on your credit obligation. There are a dozen different credit scores built with algorithms to predict the likelihood of default on a particular type of credit (credit card, car loan, car lease, etcetera). The credit score is a tool to allow increased retail consumption.

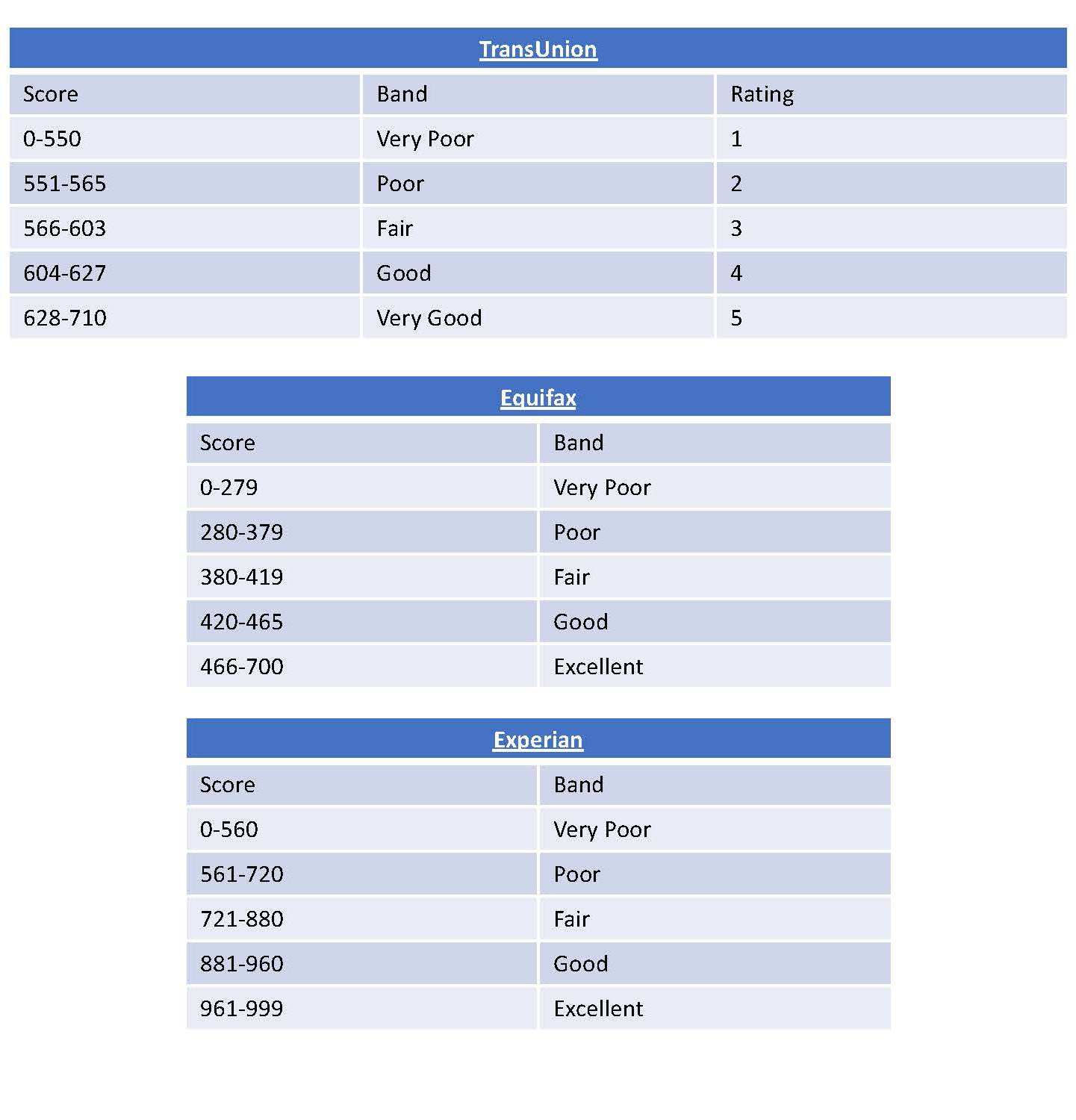

Credit in the United Kingdom is handled by three agencies cleverly called Credit Referencing Agencies (CRA’s). TransUnion, Equifax, and Experian are the three most commonly used. Experian and Equifax give you a credit score that can range between 300 to 850 and TransUnion gives a rating between 1-5, depending on their specific criteria and system tracking.

Credit scores help you secure major things such as an apartment and phone or help you get the best interest rates on loans and financing options for personal or business needs. If you’re looking to make large purchases like a car or mortgage, a strong credit score can be what saves you hundreds to thousands of dollars in the long term.

There are several types of people who tend to check credit scores:

- Banks and Credit Card Companies

- Landlords

- Employers

- Telephone Providers

How to establish credit as an expat

Now that we know a bit more about credit, let’s delve into ways to begin establishing it.

Opening a Bank Account

When you first arrive in the United Kingdom, you should set up a local bank account so your employer can direct deposit your paycheck when you secure a job. This will also put the ball in motion for many great credit-building opportunities.

There are some important documents you’ll need to open an account:

- Photo ID (a passport with your UK visa or Citizenship Status)

- Proof of Address (For some additional workarounds check out our London Banking City Guide)

- Employment Contract or School Acceptance Letter signed in blue ink

When moving to the UK, you’ll need to have an established residence in order to set up a bank account. However, if you open an international prior to entering your new country, you may not need to show proof of residency. If you choose this method, you’d simply need to provide your passport and one form of documentation that acts as proof of your address in the meantime such as an employment contract or school acceptance letter.

Expat Banking Options

Top bank account companies:

- HSBC – you can open an account from your home country but will need a UK rental agreement or you can potentially change your address on your account to your temporary stay account and print that out.

- Barclays – you can open an account potentially in your home country before coming to the UK

- N26 – for online-only mobile banking

- Monzo – online mobile banking trusted by many expats

It would be smart to see if your current bank has branches in the UK (e.g. Citibank UK or Barclays) and seeing if they can create an account for you.

Renting an Apartment

In order for you to secure a place you first need a bank account. After your account is set up it is recommended to either use an estate agent or sites like Zoopla to find a rental property. Once this is done, you must bring your visa, passport, and proof of address to open an account. Also, since finding a place might be a little tricky, it is recommended to locate temporary housing in the meantime. In addition to being at least 18 years of age, here are the documents you will need to bring with you when looking to rent an apartment.

- Proof of Identity

- Proof of Employment and Salary

- References

Setting Up Your Utilities

Setting up your utilities is not only a necessity but making regular on-time payments will help to establish yourself and start building credit. Be sure you do not sign up for online billing to start. You will need those paper statements as proof of address for things to come. Utilities include your water, power, electricity, cable and Internet.

Credit Cards

Getting a credit card is a great way to start building credit. For an expat that might be easier said than done since national and local banks tend to cater to citizens.

A few things you should consider:

- Start with a low credit limit. A credit limit means that you do not ask for the maximum amount of credit money a provider may offer or check if the provider can give can you a lower limit than advertised, which they tend to be able to. Let’s say Barclay’s offers you a credit card with a $2,000 credit limit, ask them if you can make it $500 instead or if they have a card that has less than a larger amount. In this way, you most likely increase your chances of being approved due to lower risk associated with your borrowing!

- While a lower credit limit does offer a better chance of securing credit card, it does not have a big impact on your credit score. After a few months of timely payments, you should enquire about increasing your credit limit.

- Enquire about a secured credit card (e.g. Capital One’s). A secured credit card is one that requires you to put down a cash refundable security deposit in order to get the credit card. This is great since it limits your spending and shows how responsible you are.

Documents you’ll need:

- Photo ID (a passport with your UK visa or Citizenship Status)

- Proof of Address (you can do this by either changing your bank address from your previous bank and printing that updated statement with your UK address or providing a utility or rental agreement)

- Employment Contract or School Acceptance Letter

Getting a Phone

When setting up a mobile phone in the UK you have the following options:

- Get a UK Prepaid Sim Card or UK Contract Sim if your phone is on the GSM network

- If your phone isn’t on the GSM network, getting it unlocked by your carrier or other third-party retailers

- Getting an international plan with your current carrier

- Buying a new phone in the UK

If you choose to get a new UK phone or UK Contract Sim you’ll need the following:

- Proof of identity such as a passport or National ID

- Address in UK (if you don’t have an address then get a UK Prepaid Sim to start)

- Enrollment in University/college (or acceptance letter)

- Proof of employment (or acceptance letter)

- Bank details

Therefore, it is important to have your credit and bank account set up to ease the process when they run a credit check. Check out Expatica for phone carriers recommendations and breakdowns.

Below are a few UK phone carriers you can check out and compare deals to:

Why Credit Matters

At the end of the day, your finances help make life easier for you by lowering your rates for deals, securing an apartment or mortgage, and allowing you lower interest rates. It can be a beast of information to take in but don’t worry. Take all of this one step at a time and trust that you’ll be able to manage!

Good luck and press on!