When it comes to health insurance, it can be a bit of bore, but the truth may lie in its lack of transparency and understanding by many. When you hear the terms co-pay, premiums and out-of-network it can make the head ring. As an Expat, it’s important to understand the system, the terminology and what’s offered as it will most likely be different than what you are used to.

Health Insurance- US-style may seem confusing and downright mind-numbing but that is no reason to avoid it. It may be tempting to skip out on Healthcare or think you’ll rely on your local provider from your previous country, but when it comes to healthcare in the US, it’s a must. After reading this guide, you’ll be ahead of the 4% of US citizens who understand their own health insurance system.

Healthcare insurance is what allows you to trust that whether rain or shine, flu or pneumonia, cut or injury, you’ll be able to get professional medical help at a reasonable price. Health insurance is what you pay into, either monthly or yearly so that you don’t get hit with high medical bills. Whether you have a planned visit or unexpected accidents, health insurance can enable you to save big money.

Understanding the US Healthcare System

In the United States, there is no National Health Care system like what is found in most European countries. Individuals residing in the US, whether a citizen or legal resident, pay into a private healthcare system. On the flip side residents without healthcare insurance will incur large medical bills when illness or injury comes up. These high medical costs are the biggest factor that contributes to the 62% of bankruptcy filed in the US, according to the American Journal of Medicine.

The government does, however, fund two programs, Medicare and Medicaid, but these are intended for the elderly (65+), the poor, and the disabled. The World Health Organization noted that in 2012 the US had spent 17% ($2.8 trillion dollars) of its GDP on health care – which is more than the United Kingdom and Northern Irelands GDP combined. And the worst part, Americans aren’t any better off or healthier for it.

Many Americans and working expats have their medical insurance subsidized by their employers. Even with this employer subsidy, not everything is covered, and every plan is different. The devil is in the detail so read and re-read your plan.

Since 2010, The Affordable Care Act (Obamacare) was passed in the US, which reformed the health care system by allowing millions of uninsured Americans to now legally have healthcare. Obamacare also influenced expats by not allowing insurers to deny patients with pre-existing conditions and allowing them to see the doctors of their choice. You do not need to be a US Citizen to purchase US health insurance, but you do need to be a lawful resident or a green cardholder.

Costs for Healthcare

With so many plans and different circumstances, it can be tricky to say exactly how much a particular procedure or checkup will cost.

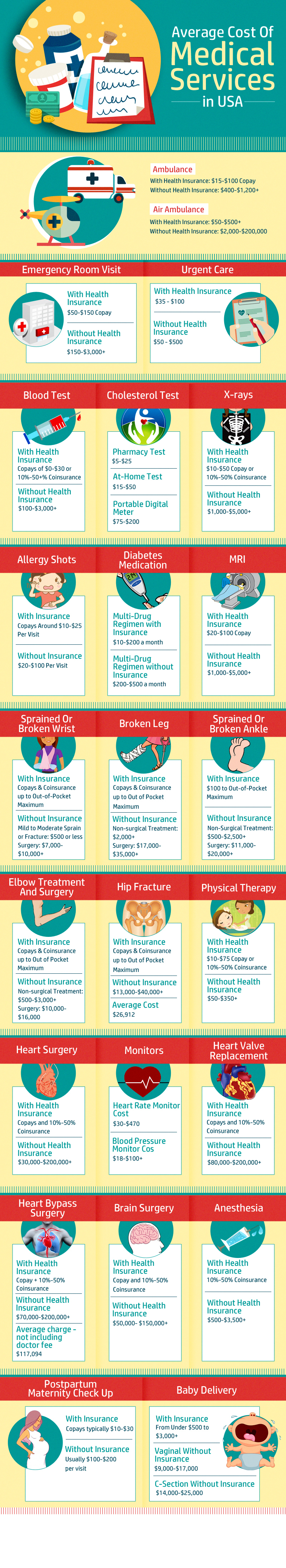

Below you can see the great infographic that Visitors Coverage put together highlighting the average medical costs with and without insurance. Keep in mind these numbers are not current as of today and vary by state and city.

Questions to ask potential insurers

It is recommended to ask for a comprehensive insurance plan if living in the US (rather than budget). American doctors tend to order more tests and scans than the European norm. Tests tend to be more expensive than European and Oceanic standards and are often not covered in most budget plans. (Budget plans typically cover in-patient care only and tests may be ordered through out-patient consultation.)

A few suggested questions to consider:

What are the premiums?

What will my deductible and co-pays be?

Does the insurance require preauthorization for hospital visits, treatment, and out-of-network services?

Do you cover pre-existing conditions?

Do you provide evacuation, terrorist, or critical emergency coverage?

What is my out-of-pocket maximum?

Providers for Expats

As an expat, you’ll need international health insurance as opposed to just travel insurance. International health insurance covers individuals staying in the US for long-term stays (e.g. 6 months or more). We recommend checking with your employer about their coverage assistance or health insurance plans to see if what they offer covers the needs you have. Check out our article on Getting Health Insurance Overseas for more added information.

If you will not have an employer, then it will be up to you to purchase it.

Here are a few private companies that provide support for expats:

- Cigna – they provide insight into the health system, culture, and finance of the host country. Service up to 86 million customers worldwide. Cigna’s Global Health plan can be done in quarterly, monthly, or yearly payments. Flexible deductibles and options to modify plan for outpatient and emergency services to leave the country.

- IMG – provides several options to choose from. Their Expat insurance has a cash incentive to reduce upfront cost. A network of 17,000 physicians and facilities. Provide 24/7 access to emergency needs.

- Aetna – specialize in long-term health insurance coverage. They cover pre-existing conditions. In addition, they have 1.4 million physicians and facilities worldwide.

Questions to help you evaluate plans

As you search for plans it’s important to be honest about how coverage impacts your life.

Think about:

How many visits you had the previous year, how many times you wanted to go to a medical professional and didn’t, and how much you can spend if a catastrophic event happened?

If you’re already employed, check with them regarding the plan details for dental, vision, life, and disability benefits?

Are prescription drugs covered?

What are the providers in-vs-out of network coverage?

Do they have a catastrophic plan? Usually, this is the basic insurance plan that gives you the bare minimum coverage.

Do they offer telemedicine coverage? This allows you to see a doctor through video chat for certain conditions.

Alternatives to the Traditional

Its 2019 and we are busy human beings. Making appointments to see a doctor when you have a quick question is difficult to squeeze in for working people and parents. Having access to telemedicine is a new service quickly on the rise. This service gives you access to doctors and medical professionals via text message and video chat. It’s worth asking if a potential provider offers this service. Here are a few apps that allow for virtual doctors and online health access.

98point6 – On-demand primary care delivered by board-certified physicians via the ease of a mobile app. No appointments, no travel and no waiting time. Must be 18+ and reside in the US.

Teladoc – 24/7 access to U.S.-licensed doctors by phone or video. Must reside in the US.

Lemonaid Health – Online doctor’s office for video chat and mail order pharmacy. Offering convenient care at an affordable price. Not open 24/7. Must reside in the US but not yet available to those in Kansas, New Jersey, and Texas.

Also consider forward-thinking companies like Oscar and Stride Health, which can potentially service expats within the NY, LA, SF regions.

Terms to know

Premium: how much you pay monthly or yearly for your insurance plan.

Deductible: the amount you pay before your insurance kicks in (e.g. Let’s say you have a $10,000 medical bill. You would pay your premium, let’s say it’s $200/mo premium and $1000 deductible, so you’d have $9,000 covered by your insurance).

*it may be tempting to get a higher deductible for a lower monthly premium, but think about how much you can actually spend. If your deductible is too high, it can leave you at risk and hurt you financially!

Co-payment: a dollar amount you pay for receiving services (e.g. a doctor’s visit cost $500 with a co-pay of $50, so you pay only the $50).

Co-insurance: a percentage amount you pay for receiving services (e.g. a doctor’s visit cost $500 with a co-insurance of 10%, so you pay only the $50).

Out-of-pocket maximum: a dollar amount you must pay for expensive medical bills (e.g. let’s say it’s $200/mo premium and $1000 deductible, and out-of-pocket maximum of $5,000, and a medical bill of $10,000, you’d have to cover either $6,000 or $5,000 depending if your insurance counts your deductible towards your out-of-pocket).